city of mobile al sales tax application

Federal Tax ID Required Sole Proprietor need SS Corporation or Sole Proprietorship Name. 2018 Whiskey Tax updated Dec.

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Chicago National

State Zip Code Business Phone.

. Tax License Application. Other Phone Business Fax Email Address. Our window hours will be extended for the Mardi Gras season.

Starting 211 - 225222 hows will be Mon. Mobile AL 36652-3065 Office. The minimum combined 2021 sales tax rate for Mobile Alabama is.

Rental Tax Return- City Police Jurisdiction updated Oct. We also processes the monthly Mobile County SalesUseLease Tax. The application should be delivered to the Traffic Division Commander at the Police Headquarters at 3721 26th Avenue Northport AL 35473 at least 3 weeks in advance of the date of the parade.

800 to 430 pm. Revenue Office Government Plaza 2nd Floor Window Hours. 2 Choose Tax Type and Rate Type that correspond to the taxes being reported.

5 on 100 or less in tax. With local taxes the total sales tax rate is between 5000 and 11500. Number of Locations in Baldwin County.

Rental License Detail Form. Declaration of US Citizenship Form. Leasing Tax Form 3 PDF FILE Petition for Release of Penalty PDF FILE Sales Tax Form 12 PDF FILE Seller Use Tax Tax Form 13 PDF FILE Business License Application PDF FILE City of Mobile Alcoholic Beverage Application PDF FILE City of Mobile Business LIcense Overview External Link.

2018 Wine Tax updated Oct. A mail fee of 250 will apply for customers receiving new metal plates. Seasonal Vendor License Application.

Sales Tax Form 12 PDF FILE Seller Use Tax Tax Form 13 PDF FILE Business License Application PDF FILE City of Mobile Alcoholic Beverage Application PDF FILE City of Mobile Business LIcense Overview External Link. Plus 2 on tax of 100 if any if submitted prior to. We will begin accepting returns on.

Where Do I Register With The City of Mobile. Revenue Department Contacts Jamie L. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100.

Drawer 160406 Mobile AL 36616-1406 Telephone. Forms and Documents -- Revenue. Box 327490 Montgomery AL 36132-7490 Telephone 334 242-2677 Counties.

Did South Dakota v. The Mobile sales tax rate is. There are four ways to make application for a business license.

The Alabama sales tax rate is currently. For information on remitting Baldwin County sales tax please call 251-943-5061. Alabama AL Sales Tax Rates by City A The state sales tax rate in Alabama is 4000.

The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing businessesprofessions doing business within the Mobile License Tax Jurisdiction. SALES USE TAX MONTHLYTAX RETURN CITYOF MOBILE POBOX 2745 MOBILEAL36652-2745 PHONE 251 208-7461 FIGURES MAY BE ROUNDED TO NEAREST DOLLAR Is this a final return Yes No. At this time the City of Daphne does not collect tax in our Police Jurisdiction.

General 350 DISCOUNT CANNOT BE TAKEN. Please call the Sales Tax Department at 251-574-4800 for additional information. Mobile Vendor License Application.

Voluntary Disclosure Agreement PDF FILE Insurance. The County sales tax rate is. Date _____ title _____ signature _____ type of taxtax area gross taxable amount total deductions net taxable tax rate gross tax due.

I-65 Service Road South Zip 36606 PO. The sales tax rate in the corporate City Limits of Daphne is 95 4 to the State of Alabama 3 to Baldwin County and 25 to the City of Daphne. However non-state administered local taxes that may be filed through MATONE SPOT may have a different discount rate and MAT has been programmed accordingly.

Discount if paid on time. Alabama has recent rate changes Thu Jul 01 2021. Mardi Gras Vendor Information External Link.

Type of TaxTax Area A Gross Taxable Amount B Total Deductions C Net Taxable A-B D Tax Rate E Gross Tax Due C x D Sales Tax a. Or Updated for County Tax ID - Sales Use Tax Application. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions exceptions exemptions proceedings requirements rules regulations provisions discounts penalties fines punishments and deductions that are applicable to the taxes levied by the state sales tax statutes except where.

Please note however that the monthly discount may not exceed 40000. Business License Application No Physical Location This includes non-local businesses and residential based businesses. Or Business Name dba Mailing Address City.

Insurance Business License PDF FILE. 3 If you are an established Mobile County taxpayer skip One-Time Filing and enter your current Mobile County Sales and Use Tax account number in the Jurisdiction Account field. See reverse side for instructions further information.

800 to 300 Monday Tuesday Thursday and Fridays and 800 to 100 Wednesdays. General rate 350 automotive rate 175 machinery rate 175 use tax. Laurel Avenue Foley AL 36535 Monday through Friday 8am5pm Mailing Address PO.

Rental License Tax Report. Mobile Vendor Ordinance 2019-5104. Applications for Parade Permits must comply with the City of Northport Parade Ordinance.

This is the total of state county and city sales tax rates. Mardi Gras Vendor Information External Link. Baldwin Conecuh Monroe Choctaw Escambia Washington Clarke Mobile Wilcox MONTGOMERY 2545 Taylor Road Zip 36117 PO.

If yes attach explanation and date closed _______________ 1Gross SalesUse Tax A Gross sales of new and used vehicles semi-trailers and truck trailers. Select the Alabama city from the list of cities starting with A below to see its current sales tax rate. Business License Application for a Commercial Address.

Late fees are 1500 plus interest and cannot be waived. MOBILE Bel Air Tower Suite 100 851 E. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100 mail fee for decals.

SOLE PROPRIETOR PARTNERSHIP CORPORATION LLC. Box 1750 Foley AL 36536 Who handles the.

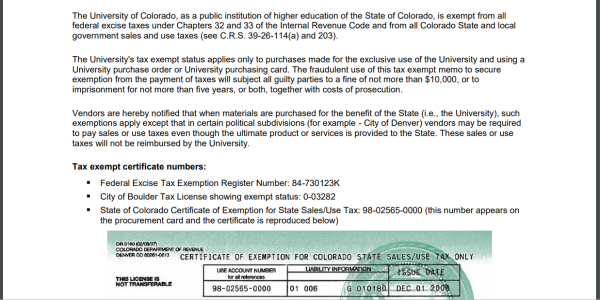

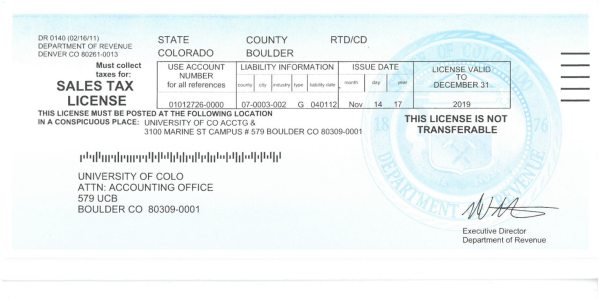

Sales Tax Campus Controller S Office University Of Colorado Boulder

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa W2 Forms Irs Forms Irs

Michigan Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Word Bill Of Sale Template Templates Bills

Sales Tax Campus Controller S Office University Of Colorado Boulder

The Admiral Hotel Mobile Curio Collection By Hilton Hotel Central Business District Outdoor Pool

Employment Verification Letter Template Microsoft Unique Employee Information Form Template Free Student Information Student Information Sheet Employment Form

State Of Nevada Marriage Certificate Issued By Diana Alba State Registrar Nevada Carson City Marriage Certificate

Multipart Oil Change Forms Oil Change Invoice Template Invoice Template Word

Be A Part Of World Free Tax Zone Register Your Company Today Business Management Business Support Services Business

Where Is Foley Alabama Time Zone Map Map Alabama

Pin By Amanda Pham On Staunch Business Names Letter Sample Business Tax

New York State Sales Tax Login Tax Ny Gov File Online New York State New York Tax

How To Create A Tax Client Information Sheet Download This Tax Client Information Sheet Template Now Credit Repair Business Business Template Templates

States With Highest And Lowest Sales Tax Rates

Sales Tax Holiday For School Related Items August 7 9 School Related Tax Holiday School

Yesco Receives Proclamation For 101 Years Of Light Https Www Signshop Com Lighting Electric Lighting Fixtures In 2021 The Proclamation Electric Lighter George Young